Across Washington State public schools are facing a worsening budget crisis that threatens to spiral out of control, causing cuts to programs, teacher layoffs, and even school closures. The future of our public schools is at stake.

Unfortunately, the state legislature continues to deliberately and knowingly underfund public education, with state spending per pupil actually shrinking in recent years when adjusted for inflation.

The short version of this post: We’re asking you to tell the legislature to step up and amply fund our public schools, as the state constitution requires, by passing a wealth tax as well as eliminating the unconscionable cap on special education funding.

The longer version:

It’s become clear that the legislature’s solution to the McCleary case, adopted in 2017, is failing to provide our schools the funding that’s necessary to educate our kids and meet their needs.

This shouldn’t be surprising. It was predicted by school districts and education funding experts as soon as the legislature adjourned in the summer of 2017. You can read more about this history and how it shapes our present crisis in the report Washington’s Paramount Duty released last fall, “Designed to Fail.”

Since we released that report, we’ve learned matters have grown even worse. Bellevue and Seattle are considering closing schools. Everett sent out an email asking families to help them decide what spending to cut, choosing between smaller class sizes, student courses, extracurricular activities, and even “safety and security.”

Smaller, rural districts are also facing a crisis. After Marysville’s local levy failed (twice) in early 2022, the district had to make huge cuts, laying off 35 teachers and eliminating middle school sports.

This month Marysville is trying one more time to pass their local levy. According to published reports, if it fails, the district may have to impose even bigger cuts, and some are even discussing dissolving the school district.

Districts weren’t supposed to need to rely on local levies after 2017. But the legislature’s deliberate, ongoing underfunding means many still do, as we see in Marysville.

Even Chimacum, home to the McCleary family, is running on budget reserves and facing cuts next year.

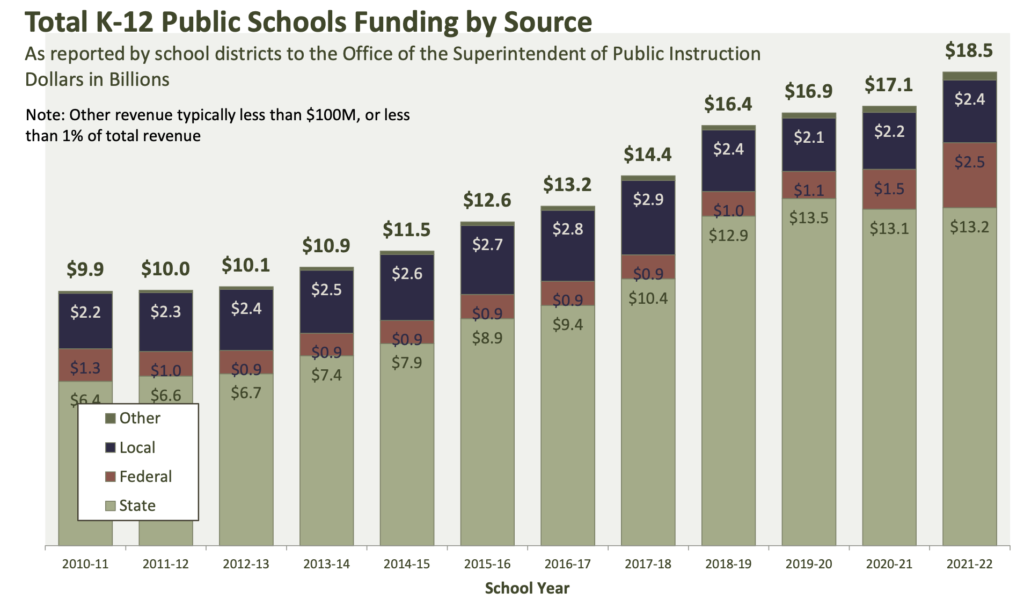

A recent report from OSPI shows what happened. The initial increase after 2017 in state funding for public schools has not only stopped, after 2020 it stalled and even shrank when you adjust for inflation. Yet districts have seen their costs rise, especially after the dislocations of the pandemic and record inflation.

An OSPI chart shows that one-time federal funding from pandemic stimulus, as well as local levies, are making up the difference between state funding and actual costs. Once that federal stimulus funding goes away in the near future, districts will face even larger cuts.

Districts have also experienced declining enrollment. But budget cuts will create a spiraling crisis, as program cuts, teacher layoffs, larger class sizes, and school closures drive even more families to leave the public school systems, causing more cuts.

One additional factor causing district budget woes is the state’s appalling cap on special education funding, which even The Seattle Times said is indefensible. The legislature caps special education funding at 13.5% of enrollment. Many districts have more students than that who need services. In Seattle and Chimacum, it’s 16%. In Longview, it’s 18%.

In his budget proposal, Governor Jay Inslee proposed a measly cap increase to just 15%, and the State Senate seems poised to stick with that insufficient amount. Thankfully, there’s a much better bill in the State House that would eliminate the cap entirely.

Clearly, the legislature’s 2017 education funding plan has failed. They need to adopt something new. That requires more funding. The best piece of news is that we can share with you is that legislators in both the House and the Senate proposed a wealth tax last month that would raise billions of dollars and, in part, go toward public education.

We’re at a crossroads right now and we need your help by contacting legislators and urging them to amply fund our public schools.

Here’s the specifics of what we’re asking legislators to do with some of the most important legislation, as well as the budget, in the 2023 session. (When you click the link, you’ll get a form that allows you to send a message to legislators to support or oppose the following bills.)

Special education

SB 5311: Oppose unless amended to remove the cap on special education funding. This is the bill that would raise that cap from 13.5% to 15%, which is an offensively small increase that falls well short of what districts actually need to provide programs and services to students.

HB 1436: Support and do not amend. This bill handles special education funding correctly, eliminating the cap entirely.

Wealth tax

SB 5486/HB 1473: Support. Polling shows 67% of Washingtonians back a wealth tax, so this shouldn’t be difficult or controversial. The legislature should also amend it to provide more assurances that a sufficient amount of the money raised will be allocated to K-12 public school districts rather than simply put in the Education Legacy Trust Fund.

Budget

In a few weeks legislators will propose their budgets for 2023-24. The legislature should adopt a budget that provides at least $1 billion more for K-12 public schools and ensures no district must make any cuts. In addition to passing a wealth tax, they should also raise the capital gains tax rate to 10%, up from its current level of 7%.

Thank you for taking action for our schools!